The local mayor announced the new legislation today after a video surfaced last week showing sex acts being performed by a young British holidaymaker at a club night called Carnage. The resort’s reputation has been steadily deteriorating for years, but recent revelations about bars and clubs where tourists are encouraged to get drunk and engage in sexual behaviour in public proved the tipping point. Manuel Onieva, the Mayor of Calvia, a region including Magaluf, said the new law was an expression of his “total rejection and anger at the activities which were carried out in a video which is currently on the social media circuit.” In an attempt to clean up seedy bar crawls, any company wanting to operate one in the area will now need to apply for a licence through the town hall. In order to be granted a licence they will have to “prove their responsibility and show that they have the appropriate civil insurances in place,” the mayor said.

© Edward Burtynsky, courtesy Flowers, London Dryland Farming #13, Monegros County, Aragon, Spain, 2010

Canadian photographer Edward Burtynsky is having a London moment. Not only are his familiar works on the oil crisis on view but he is also exhibiting a new series examining the impact of long-term farming in Monegros, Spain.

© Edward Burtynsky, courtesy Flowers, London Dryland Farming #21, Monegros County, Aragon, Spain, 2010

These photographs are looking at the tradition of dryland farming carried out over many generations in the north-eastern part of Spain. It's an agricultural region where the land is semi-arid, sparsely populated and prone to both droughts and high winds. The land is made up of sedimentary rock, gypsum, and clay-rich soil. The photographs show the impact of these conditions, as well as man's expanding foot print.

© Edward Burtynsky, courtesy Flowers, London Dryland Farming #8, Monegros County, Aragon, Spain, 2010

Burtynsky is shooting the photos from a helicopter, two thousand feet up: so high that there are almost no details to be identified. The topography looks like an abstract painting.

© Edward Burtynsky, courtesy Flowers, London Dryland Farming #27, Monegros County, Aragon, Spain, 2010

Despite a scarcity of water, generations of farmers have continued to farm, so the photos are a contrast between nature's untamed forces and man's attempts to harness it. The cracks and crevices form writhing lines with deep earthy tones.

© Edward Burtynsky, courtesy Flowers, London Dryland Farming #31, Monegros County, Aragon, Spain, 2010

Two people have suffered serious burns and some homes have been engulfed by the fire.

Two people have suffered serious burns and some homes have been engulfed by the fire.

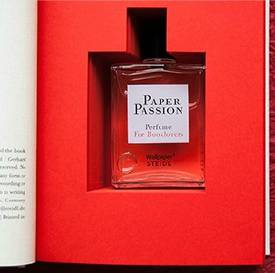

Paper Passion fragrance by Geza Schoen, Gerhard Steidl, and Wallpaper* magazine, with packaging by Karl Lagerfeld and Steidl.

Paper Passion fragrance by Geza Schoen, Gerhard Steidl, and Wallpaper* magazine, with packaging by Karl Lagerfeld and Steidl._afp.jpg) Officials say the flames have been fanned by strong winds

Officials say the flames have been fanned by strong winds